The question on every real estate investor’s mind in 2024 is if interest rates will go down in 2024. By most counts, interest rates on mortgage should come down in 2024 from their highs in 2023. The key question is really by how much? Let’s dig into the details.

Current State of Mortgage Rates

As of January 16, 2024, according to Mortgage News Daily, a 30 year mortgage rate was around 6.8% for a highly qualified borrower. This is down from a peak of around 8% in October but still up from 6.25% at the beginning of 2023.

Mathematical Background

Here’s what you need to factor in before we can get to the experts:

- Mortgage rates are loosely based off of the current 10 year treasury yield and generally trade at some yield premium to the 10 year.

- the 10 year treasury yield is based off, primarily, short term interest rates and future inflation expectations.

- Therefore, mortgage rates (for highly qualified borrowers) are primarily influenced by short term interest rates and inflation expectations.

Mortgage rates are currently being propped up by the Federal Reserve as it hopes to stamp out any leftover inflation from the COVID pandemic. The Federal Reserve is currently holding its target Federal Funds Rate (a short term rate) at a range of 5.25% to 5.50%. This is well elevated from the early COVID pandemic days of a 0.0% – 0.25% Federal Funds Rate.

On the inflation front, CPI has been elevated above the Fed’s 2.0% target since 2021. While CPI has peaked and has come down significantly, most recently reading at 3.3%, it is still well above the 2.0% goal.

So all indication is that interest rates on your mortgage are coming down. Why is that? What are the experts saying? Let’s start here.

Where Are Rates Heading?

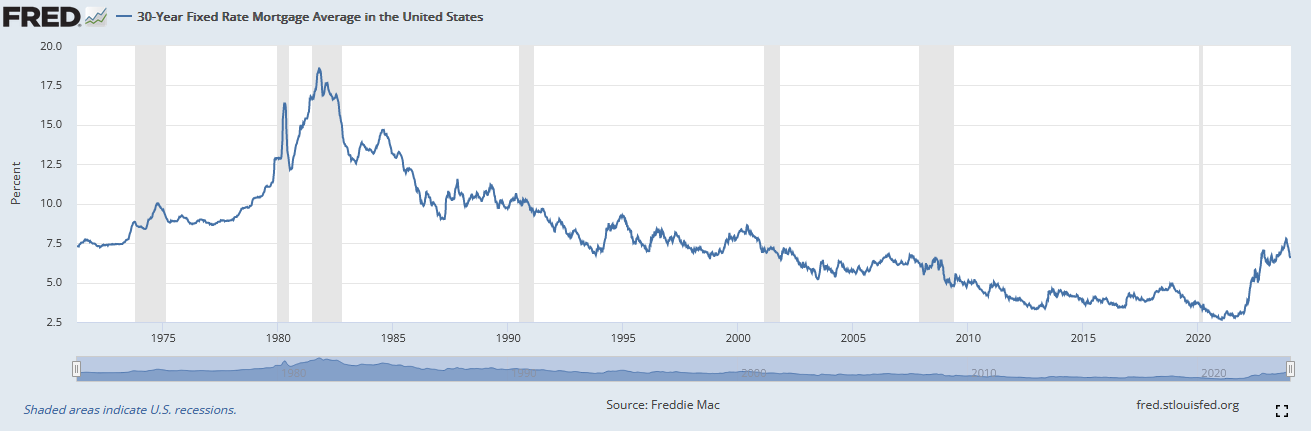

What Does History Tell Us?

History tells us that we should not expect rates to reach COVID lows anytime soon. Maybe never. Depending on the time period you choose (which is important), rates hovering around 6-7% are not that crazy. But as we all know with investing, past performance is not indicative of future performance. Just because rates have been high historically doesn’t mean that they should be.

Bottom line with this graph… be prepared to be patient and manage your expectations accordingly.

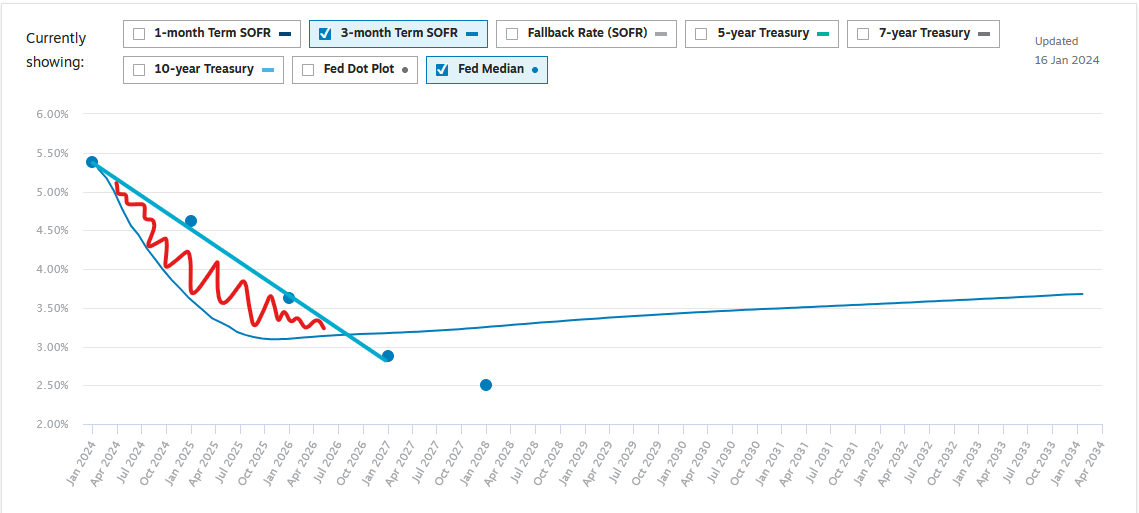

What the Market / Wall Street Are Saying?

First, all indications from the Federal Reserve are that there will be rate cuts in 2024. However, as the market likes to do, it is making its own assumptions. According to short term yield curves, the market is pricing in short term rates reaching approximately 3.70% by the end of 2024. As demonstrated below, there is quite a disconnect between the Fed and what the market is expecting.

Why the disconnect? One word: Inflation. Inflation has, for the most part, been tackled and we are well off of the extremes of mid-2022 to early 2023. However, this last bit of inflation may be the most difficult. CPI (December 2023) remains around 3.3%, which is well above the Fed’s inflation target of 2.0%. So while the market anticipates more cuts and inflation coming down, the Fed is signaling that it may take longer.

The key question here is whether the Fed will feel comfortable cutting rates with CPI well above 2.0%, even though it is trending down? Or will it hold rates higher for longer?

What Are The Experts Forecasting?

I polled several institutions and summarized forecast mortgage rates by the end of 2024.

- Redfin: Mid 6%’s

- National Association of Home Builders: 6.77%

- Fannie Mae: 6.5%

- Mortgage Banker’s Association: 6.1%

So with rates currently around 6.8%, experts are not exactly predicting a massive crash in interest rates. So what do I think?

My Predictions

I personally am siding with the experts on this one. Inflation remains elevated and the Fed does not want to risk lowering rates too soon. They already blundered significantly by leaving rates too low for too long, exacerbating inflation. So while I think there will be some rate cuts in 2024, I am not expecting rates to fall off of a cliff and I think we will land closer to the Fed median.

Therefore, my prediction for year-end mortgage rates as of January 16, 2024, is somewhere between 6.25% and 6.50% by December 2024.

Hopefully this was helpful and hope to have more content out like this soon!

DISCLAIMER – THIS ARTICLE IS NOT FINANCIAL ADVICE. THIS ARTICLE DOES NOT CONSTITUTE A BUY, SELL, OR HOLD RECOMMENDATION ON ANY SECURITY MENTIONED HERE. THIS ARTICLE CONSTITUTES MY OPINION AND NOT A STATEMENT OF FACT. ALL INFORMATION REGARDING THE FINANCIAL SECURITIES MENTIONED IS ACCURATE AS OF JANUARY 16, 2024. DO YOUR OWN RESEARCH.