Today we are going to answer the question: Should you pay off your mortgage early? There are two angles to attack this from, the financial angle and the emotional angle. But in general, it makes sense to pay off your mortgage if your interest rate is more than your expected investing returns.

Let’s break that down.

What Does Making Early Mortgage Payments Do?

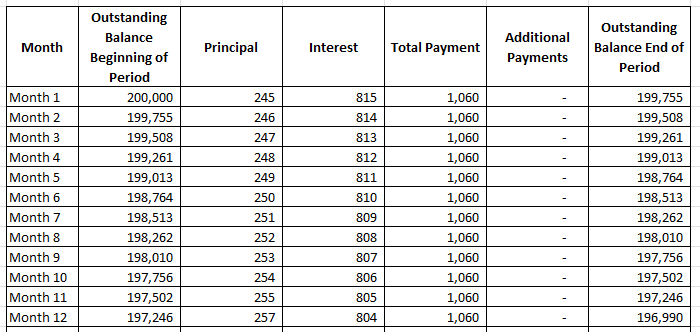

Let’s take the following example. I took out a $200,000 mortgage at a fixed 5% interest rate over 30 years. My first few monthly payments would look like this:

As your loan amortizes over 30 years, a portion of your payment goes toward principal each month. As time goes on, your principal balance slowly goes down and you pay less interest. Eventually, your outstanding principal reaches zero and you pay it off!

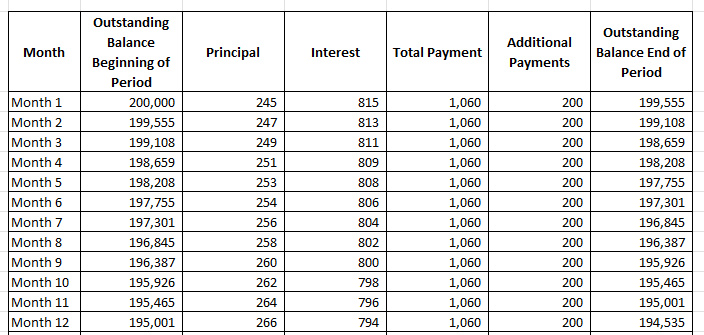

So what does it look like if you make extra payments? Remember, with a fixed rate mortgage like this, your total payment amount doesn’t change, but the amount of interest you pay each month vs. principal goes down.

Let’s use the same example as above but layer in an extra $200 per month in payments.

Based upon this, your outstanding balance at the end of year one would drop from $196,990 to $194,535. Look at that Month 12 payment too. Your interest paid in that month would drop from $804 to $794. In other words, these early payments are earning you a return in the form of interest you no longer have to pay. This is equal to 5% annually of the amounts you pay early.

So now that you know what’s happening, let’s answer the question of should you pay off your mortgage early.

Does It Financially Make Sense To Pay Off My Mortgage Early?

The Formula

From a strict financial perspective, the decision to pay off your mortgage is quite simple. Take your mortgage interest rate, say 5% and compare it to your expected return on other investments. If your mortgage rate is higher than your expected return, it probably makes financial sense to pay it off early. As a quick formula:

- Mortgage Rate > Investing Returns = Make Early Mortgage Payments

- Mortgage Rate < Investing Returns = Make Minimum Mortgage Payments

Let’s break this down a little further.

What Should I Assume As Investment Returns?

This is completely dependent on your risk appetite and what you typically invest in. If you’re investing in the broad stock market, your expected return is generally between 7-9% annually. If you’re more risk averse and only invest in treasuries/bonds, it may be more like 3-4%.

So in our example, 5% is less than projected long-term stock returns of 7-9%. Meaning we would not pay off our mortgage earlier. However, if you aren’t comfortable investing in stocks and your invested cash earns a low return, it may make more sense to pay off your mortgage.

For The Very Risk Averse

For those who are extremely risk averse and do not like the variability of investing returns, paying off your mortgage early is the perfect option. Your return paying off your mortgage is fixed and equal to your interest rate, which we discussed above. So by paying it off early, you are earning a risk free return.

The Emotional Argument For Paying Off Your Mortgage Early

So we now know how to decide financially and mathematically when to pay off our mortgage early. But I’ve ignored a very simple fact so far: Some people hate being in debt. That’s right, we’re not all emotionally cut out to owe someone $200,000 like my example above. Some people lose sleep over it, it makes them stressed out, etc.

If you are one of those people, potential additional market returns likely do not outweigh the mental benefits of paying off your mortgage early. It’s that simple.

The Bottom Line

You should now know when it may be financially beneficial to pay off your mortgage early. You hopefully should have done some self reflection as to the emotional toll a mortgage does (or doesn’t) take on you. Remember, if you can stomach the debt and earn a higher return elsewhere, godspeed. But if you cannot stomach the debt, paying off your mortgage may just be the thing for you.